Second, they quantify issues, so that report recipients can tell if the spotlighted items represent significant concerns that warrant immediate attention. Third, they foster communication, since they are forcing the report recipient and responsible manager to discuss the highlighted issues. Finally, the preceding points make it much more likely that the items contained within performance reports will be dealt with – if not reported, they tend to persist for long periods of time. An audit report is a document generated by your auditors that reviews your company’s financial records. A formal audit will ensure that your financial statements are prepared in accordance with generally accepted accounting principles, or GAAP. That’s why simplifying and automating the accounting reporting process is so important.

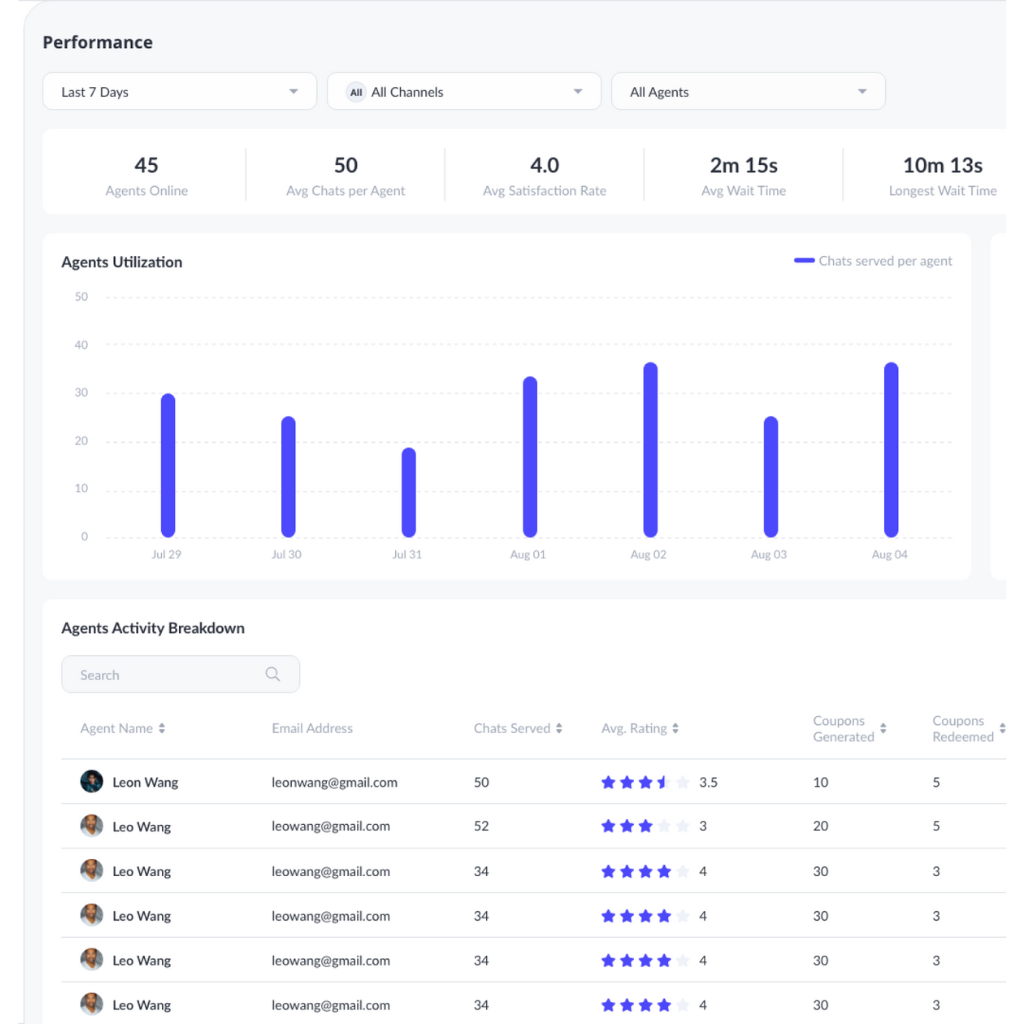

Example of a company performance report

For example, if you see that one of your suppliers offers an early payment discount, perform a few quick calculations to see if your cash flow can handle making that payment early. When viewing this report, you’ll know right away which invoices must be paid first, and you can plan your cash outlays accordingly. Ensure the receiver understands what’s going to happen next and has clear takeaways from the conversation. I create clear, in-depth articles on data analytics and marketing topics for our blog. With four years of experience in the startup and product marketing space, I love reading and writing about all things tech. When not at my desk, you’ll find me baking, traveling to new places, or hiking with my dog.

Types of accounting reports

Typically, your supplier will issue credit memos if delivered goods were damaged on arrival or if there was a billing error. Your vendor analysis report shows the total amount that each of your suppliers has billed you over a given period. He’s a co-founder of Best Writing, an all-in-one platform connecting writers with businesses. He has built multiple online businesses and helps startups and enterprises scale their content marketing operations. He worked with TIME, Observer, HuffPost, Adobe, Webflow, Envato, InVision, and BigCommerce. To better articulate the need for change, explain the downstream effects of the employee’s behavior on the team, company and their own career prospects.

The impact of performance reporting on organizational effectiveness and employee development

It’s important to include concise phrases in the review, but they should also be impartial. If you are delivering constructive feedback, observations should also be as accurate and measurable as possible. An accountant’s job description usually has more to do with competencies, proficiency, and accuracy. Their jobs are not always focused on leadership and team-based cooperation.

Coupler.io is an analytics and marketing reporting tool that allows you to consolidate your accounting data and turn it into self-updating reports like the ones introduced above. It provides an overview of accounts payable so you can understand who your main creditors are and how much you owe them. In summary, notes to financial statements provide clarity and context about the numbers in your reports. They are crucial for helping you and your stakeholders, auditors, or governing bodies understand how your records are prepared and interpreted. This report outlines the transactions between your company and its shareholders over a specific accounting period.

- If the baseline is not reasonable, then any outcomes derived from it will be invalid.

- Use benchmarking to determine where you sit within the industry and where you outperform or underperform the competition.

- It takes into account multiple factors, such as financial statements, customer satisfaction surrounding your work, business status reports, and more.

- A PlumbBooks employee then links each tab to a pre-built Looker Studio dashboard template only once.

- Exhibit 8 shows the comparison of Leed’s flexibleoperating budget with the actual results.

How Ramp became KIPP Nashville’s biggest financial win

However, remember that a lack of attention to detail – or simple human error – can also impact your ability to make data-driven business decisions. For small and medium-sized businesses, it’s not mandatory to prepare your reports according to GAAP or IFRS rules. As a general rule, all reports should adhere to the accounting standards set out in the IFRS or GAAP frameworks.

Conducting performance reviews every 6-12 months is the standard practice. Initiate performance for new and entry-level candidates sooner, such as after three and six months, as part of their onboarding. Schedule reviews of other team members less regularly (unless there are issues with their performance). The ultimate goal of the performance review is to guide, not admonish, your team members. Your feedback should help the receiver practice the right actions and make them feel recognized for their achievements.

These reports provide insights into areas where competitors outperform them, enabling them to close the gaps and improve their performance. Technology is your trusty sidekick when it comes to creating performance reports. It’s like having a superpower that helps you gather and analyze data way faster and more accurately than doing it all manually. But that’s not all – performance reporting is a game-changer for employee development too. It helps you identify your superstar performers and those who might need a little extra support or training.

Budgeted fixed costs would remain the same because they do not change based on volume. Your accounts payable (AP) department is an integral part of your business operations. It controls nearly all cash outlays and collects financial information that helps your team make important business decisions. With the right mindset, you can strategically leverage your AP team, using AP reports and metrics to further business goals and boost your bottom line. Setting the business performance reports usually happens in the planning phase of the business.

Achievable and realistic goals improve employee morale and lead to increased productivity and profitability. Instead of reviewing the performance of each division, business performance management looks at the business as a whole. It takes into account multiple factors, such as financial statements, customer satisfaction surrounding your work, business status reports, and more. A performance report is a document that a company creates to define and measure its overall success. To do this, performance reports mainly collects specific work performance data, analyze it, and provide suggestions to help in making decisions.

The first step toward creating an effective performance report is to keep your target audience in mind. Your performance report is mainly written for the senior management, but it is also used by employees as well. With these reports, you can set realistic and achievable targets which help in improving employee morale and celebrations will also help increase overall performance and productivity. Some examples of performance reports are status reports, progress reports, trend reports, variance reports, forecasting reports, etc. A sample performance report that shows the profits generated by a group of retail stores appears in the following exhibit.

No responses yet