To calculate the sale price of an item, subtract the discount from the original price. You can do this using a calculator, or you can round the price and estimate the discount in your head. A discount allowed is when the seller of goods or services grants a payment discount to a buyer.

When should the gross method of recording purchase discounts be used?

In this lesson, we’ll review what petty cash is used for and describe how it should be accounted for with journal entries. When a bank offers compound interest, it figures the interest for each period based on the account’s previous balance plus the interest gained in the last period. Review simple interest, compare it to compound interest, and study compound interest’s definition, formula, and examples. In finance, a purchase discount is an offer from the supplier to the purchaser, to reduce the payment amount if the payment is made within a certain period of time. For example, a purchaser bought a $100 item, with a purchase discount term 3/10, net 30.

Saif Group of Companies

If you are at an office or shared network, you can ask the network administrator to run a scan across the network looking for misconfigured or infected devices. First of all, this sale is business-to-business, so in most jurisdictions in the U.S., there won’t be a sales or value-added tax , but you have to know the law for your particular situation. For instance, sales taxes may be based on the shipping destination, and internet sales may have some different rules depending on your physical location.

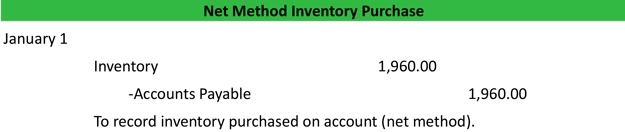

What is the net method of recording purchase discounts?

On the liabilities side, accounts payable will show the full amount owed to suppliers, offering insights into the company’s procurement and payment processes. These detailed records can help stakeholders evaluate the company’s financial stability and operational effectiveness. what does an accountant do Another important aspect of gross method accounting is its impact on expense recording. Companies using this method will document the full cost of goods sold or services rendered, again without deducting any discounts or allowances at the point of initial recording.

If Big Guitar, LLC was unable to pay the invoice by January 11, it would have to reverse the discount taken and record the actual payment. Increasingly, businesses are beginning to use digital methods over traditional methods for many of their operations. Keep reading to learn more about each accounting method and how to choose the right one for your business. As we noted previously, this can be a significant cost, and it is generally in the firm’s best interest to pay within the discount period. The difference between the amount at which Accounts Payable is debited and Cash is credited is debited to an account titled Purchase Discounts Lost. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

This example highlights how the gross method can offer a more transparent view of financial performance, which is particularly useful for internal analysis and external reporting. When comparing the gross method to the net method, the differences in revenue and expense recording become immediately apparent. The net method records transactions after deducting any discounts, returns, or allowances, providing a more conservative view of a company’s financial performance. This approach can lead to lower reported revenues and expenses, which may offer a more realistic picture of the company’s net earnings. Under the gross method, the revenue section will display the total sales amount without any deductions for discounts or returns. This can result in a higher gross revenue figure, which may be appealing to investors and analysts looking for signs of strong sales performance.

- It would be wrong to record $10,000 as a debit to Marketing Consulting Expenses and to record a credit of $100 in the account Cash Discounts.

- The net method works by recording any purchase discounts obtained from suppliers as an immediate offset to the cost of goods purchased.

- FOB specifies which party (buyer or seller) pays for which shipment and loading costs and where responsibility for the goods is transferred.

- If the home store pays for the artwork within 10 days of the sale, enter a $500 credit to accounts receivable, a debit to cash of $490 and a debit to sales discounts of $10.

Furthermore, businesses can now tap into cloud computing resources which provide them with greater storage capacity and faster transfer speeds than ever before. Examining all aspects and looking at both the long-term results and short-term gains before deciding which course of action to take will provide the most clarity when it comes time to make a decision. Generally speaking, if one way will require more work to complete but will result in higher quality outcomes, this should definitely be considered in the process. Still, other methods might save time but require more resources or take longer to execute. Based in Greenville SC, Eric Bank has been writing business-related articles since 1985. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Then, when the customer actually takes the discount, you charge it against the allowance, thereby avoiding any further impact on the income statement in the later reporting period. Cash discounts may be recorded in the books of the company using the gross method or the net method. Under the gross method, sales and purchases are initially recorded at gross amount and when the discount is taken, “Sales Discount” or “Purchase Discount” is recorded. A cash discount is a deduction allowed by the seller of goods or by the provider of services in order to motivate the customer to pay within a specified time. Another common sales discount is “2% 10/Net 30” terms, which allows a 2% discount for paying within 10 days of the invoice date, or paying in 30 days. A cash discount refers to the reduction in the price of a product or service when paid in cash.

Another important consideration when using the net method is the treatment of uncollectible accounts. Since the net method records transactions at their net amounts, any subsequent realization that a receivable is uncollectible requires adjustments to the financial statements. For example, if a company records a sale at its net value but later determines that the customer will not pay, it must write off the uncollectible amount.

This account is eventually closed into Cost of Goods Sold at the time and adjusting entry is made to compute the cost of goods sold. Digital methods are quickly emerging as the preferred choice for many modern businesses. Choosing the right method for your business is an important task that should not be taken lightly. When it comes to businesses, having the correct methodology in place can mean the difference between success and failure.

No responses yet